What is Form 6166?

What is Form 6166?

Many foreign countries withold tax on certain types of income paid from sources within those countries to residents of other countries. An income tax treaty between the U.S. and a foreign country often resuces the witholding rates (sometimes to zero) for certin types of income paid to residents of the United States. Many U.S. treaty partners require proof that the person or company claiming treaty benefits as a resident of the United States for federal tax purposes. The IRS provides this residency certification on Form 6166 (a letter of U.S. residency certification).

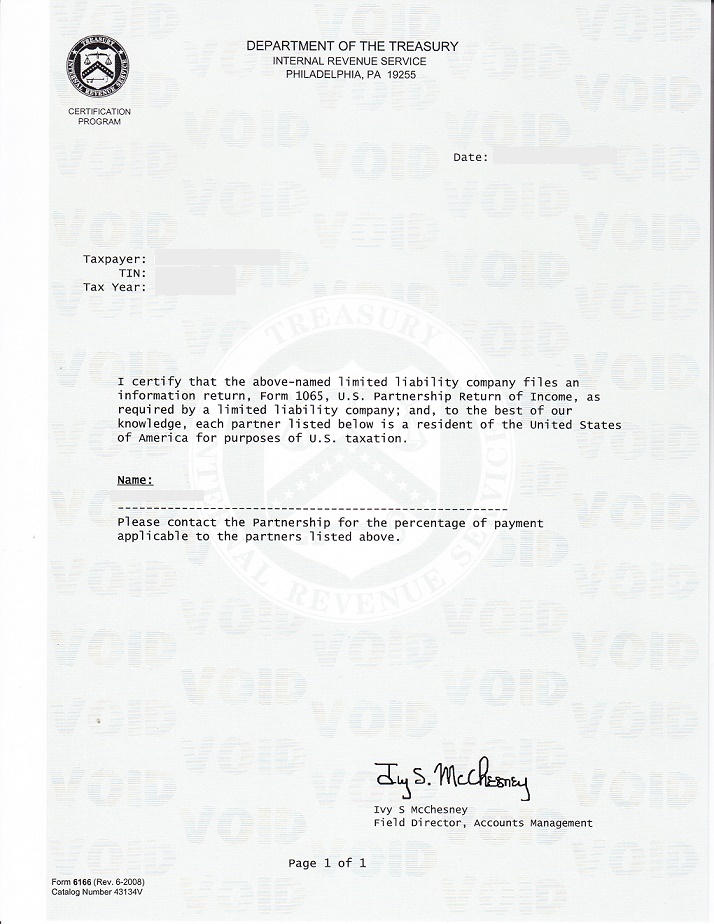

Form 6166 is a computer-generated letter printed on stationery bearing the U.S. Department of Treasury letterhead, which includes the facsimile signature of the Field Director, Philadelphia Accounts Management Center.

Who is eligible for Form 6166?

In general, the IRS will issue Form 6166 only when it can verify that, for the year for which certification is requested one of the following applies. • You filed an appropriate income tax return (for example, Form 1120 for a domestic corporation). • In the case of a certification year for which a return is not yet due, you filed a return for the most recent year for which a return was due. • You are not required to file an income tax return for the tax period on which certification will be based and other documentation is provided.

Who is not eligible for Form 6166?

In general, you are not eligible for Form 6166 if, for the tax period for which your Form 6166 is based, any of the following applies. • You did not file a required U.S. return. • You filed a return as a nonresident (including Form 1040-NR, Form 1040-NR-EZ, Form 1120-F, Form 1120-FSC, or any of the U.S. possession tax forms). • You are a dual resident individual who has made (or intends to make), pursuant to the tie-breaker provision within an applicable treaty, a determination that you are not a resident of the United States and are a resident of the other treaty country. • You are a fiscally transparent entity organized in the United States (that is, a domestic partnership, domestic grantor trust, or domestic LLC disregarded as an entity separate from its owner) and you do not have any U.S. partners, beneficiaries, or owners. • The entity requesting certification is an exempt organization that is not organized in the United States.

Form 6166 apostille guidelines

Form 6166 apostille guidelines

only original Forms 6166 are acceptable for apostilles

Forms 6166 do not need to be notarized

as Forms 6166 are federal documents, they are apostilled on the federal level, by the U.S. Department of State in Washingtn DC.